The M word, or the Metaverse, had its ups and downs, at least in the West- from “The Darling” which will give us a trillion industry, to the ‘death’ of the metaverse’ as many media announced us. But contrary to headlines, the Metaverse, alongside XR did not die. The hype might be gone, but the work around it, the researchers, creators, technologist, startups are still here.

But, how it went the story of the Metaverse and XR in other parts of the world – for example, China? Is the Metaverse alive? 🙂 What is happening there in terms of XR content creation, different industries’ perspectives, adoption and interest of users, etc? What are the trends and challenges? What are the creatives industries’ approach to the new developments in XR?

To find out, we have talked with Ashley Dudarenok 艾熙丽 – digital China expert, entrepreneur, and bestselling author.

Ashley Dudarenok is a Chinese serial entrepreneur, award winning digital expert and book author, recognised by Thinkers50 as a “Guru on fast-evolving trends in China”. She is the the founder of ChoZan 超赞 (www.chozan.co), China digital consultancy and Alarice (www.alarice.com.hk), China-focused marketing agency. Ashley and her team help world’s top companies and brands to learn for China, and learn from China.

Ashley Dudarenok is also a sought after professional speaker covering topics around customer centricity, the future of retail, technology in action, and ‘learning from China’. All keynote speeches are tailored, delivered with clarity and energy. Ashley’s spoken for BMW, Coca Cola, Disney and many more.

Ashley is the author of 11 books on digital China. She has over 90,000 followers on LinkedIn, and runs a popular China/Digital/Tech/Future themed show on her YouTube channel.

![]() TVA: There were lots of discussions about the Metaverse, and XR technologies in general; in “the west”, we had a period of “hype” for the Metaverse- everybody said it will be the next industry and we should all embark on it, and then we had the period when media announced that “metaverse is dead”.

TVA: There were lots of discussions about the Metaverse, and XR technologies in general; in “the west”, we had a period of “hype” for the Metaverse- everybody said it will be the next industry and we should all embark on it, and then we had the period when media announced that “metaverse is dead”.

How is the Metaverse and XR in China?

![]() ASHLEY DUDARENOK: For metaverse, China’s metaverse market is still in the development period. The output value of China’s Metaverse’s upstream and downstream industries exceeds 400 billion yuan, and it is predicted that in the next five years, the domestic Metaverse market size will exceed the 200 billion yuan mark at least.

ASHLEY DUDARENOK: For metaverse, China’s metaverse market is still in the development period. The output value of China’s Metaverse’s upstream and downstream industries exceeds 400 billion yuan, and it is predicted that in the next five years, the domestic Metaverse market size will exceed the 200 billion yuan mark at least.

For XR, In the third quarter of 2023, omni-channel sales of consumer XR devices (including AR and VR) in China were 126,000 units, a year-on-year decrease of 36.7%.

Among them, the monitored sales volume in the online public retail market (excluding content e-commerce companies such as Douyin, kuaishou) accounted for 41.3% of all channels, reaching 52,000 units, a year-on-year decrease of 27.8%; sales volume was 160 million yuan, a year-on-year decrease of 33.1%.

The decline in market size mainly comes from the VR product market, while AR products are still growing rapidly.

The ratio of the two types of products in the online monitoring market has evolved from 80:20 in the same period last year to 56:44 this year.

RUNTO analysed the reasons and believed that within XR industry, companies have launched price wars prematurely, and the market charm has rapidly depreciated; in addition, the more important reason is that the content and scenes are not rich enough to fully stimulate consumer interest, and naturally cannot form a healthy XR ecology.

references:

https://app.dahecube.com/nweb/pc/article.html?artid=173778?recid=658

https://finance.sina.cn/tech/2023-11-16/detail-

imzutcqm2350894.d.html?fromtech=1&from=wap

![]() TVA: We saw some regions developing their own strategies – for example Sichuan had a metaverse strategy, as did Beijing.

TVA: We saw some regions developing their own strategies – for example Sichuan had a metaverse strategy, as did Beijing.

Is there an overall vision and strategy for the Metaverse? And if yes, what are the main points?

![]() ASHLEY DUDARENOK: Background: Shandong Province proposes to promote an average annual growth of about 15% in the scale of metaverse-related industries, reaching about 150 billion yuan by 2025.

ASHLEY DUDARENOK: Background: Shandong Province proposes to promote an average annual growth of about 15% in the scale of metaverse-related industries, reaching about 150 billion yuan by 2025.

Chongqing plans to increase the scale of Metaverse-related industries to RMB 100 billion by 2025, and build a highly influential Metaverse industry cluster and innovative application pilot area in the country.

Now, China’s metaverse is also in a period of transformation.

Currently, in China, the medical metaverse, education metaverse, transportation metaverse, automotive automation and urban governance metaverse, and financial metaverse are just the first stages of their infancy. With the main goal of building an industrial metaverse and empowering the manufacturing industry, China will vigorously explore the innovation and transformation of the manufacturing industry that promotes the mutual promotion of virtual and real processes.

Strategy: We can see that the biggest feature of China Metaverse is that it is not just an initiative of a single industry or platform, it often involves the integration of multiple industries, and the government will also play a matchmaking role in it to promote development.

It is a grand strategy, a grand platform, and a grand system based on China’s future development. It is a new system of great power strategy based on the ”meta-universe combination”, proposed in the fields of science, technology, economy,

and culture based on the reality of China’s high-quality development.

Goal: In August, the Chinese government promulgated a three-year action plan for the innovation and development of the Metaverse industry. The goal is to cultivate 3- 5 ecological enterprises with global influence and a group of specialized small and medium-sized enterprises by 2025, create 3-5 industrial development clusters, and create a mature industrial metaverse.

![]() TVA: What are the sectors where XR is providing the best results and it is the most appealing in Asia?

TVA: What are the sectors where XR is providing the best results and it is the most appealing in Asia?

What are some of the most innovative solutions, ideas implemented in the Chinese Metaverse that make it different and unique on the market?

![]() Ashley Dudarenok: Metaverse plus Tourism (always co-built with government):

Ashley Dudarenok: Metaverse plus Tourism (always co-built with government):

- In August 2022, Qingdao’s virtual spokesperson ”xiaoman” went online. As Qingdao’s first urban virtual intelligent digital human IP, she is a pioneering attempt of ”technology + cultural tourism”, marking that Qingdao’s digital construction has entered the ” Huang Qian said: ”After the debut of ‘Qingdao Xiaoman’, the surrounding area was full of tourists, so we had to implement traffic restriction measures.

The average daily number of tourists near Zhongshan Road exceeded 50,000, and the store’s revenue increased 4-5 times, effectively driving the surrounding area.”Consumption is growing rapidly.” - In August 2023, many guests can easily obtain exclusive virtual images through computers, PADs and VR glasses, and quickly and conveniently enter the Henan(河南) Cultural Tourism Metaverse Space – Yúan Yǔ zhoù, where they can immersively visit the famous mountains and scenic spots in the Central Plains and feel the charm of the Central Plains culture.

Access Henan’s well-known cultural and tourism IPs online without any barriers, enjoy the beautiful scenery of the Central Plains up close and immersed, and get all-round cool travel guides. Although these scenic spots are more than 300 kilometres apart in reality, they can still be included in your ”luggage bag” in one fell swoop, easily realizing a new experience of ”online reading” and ”offline travel”

Metaverse plus E-commerce: China’s E-commerce industry is developed, so the Metaverse related to E-commerce is also very popular. Taobao will create a metaverse called ”Future City” in 2022.

In this virtual space, there are commercial streets and advertising screens. Users can directly enter this new virtual world with their avatar in Taobao life, where they can go shopping, shop, draw prizes, and interact with strangers.

Digital Currency and Blockchain Integration: China has been actively exploring the integration of digital currency and blockchain technology within its metaverse.

The introduction of the Digital Yuan (e-RMB) and initiatives like the Blockchain-based Service Network (BSN) have the potential to transform digital transactions, ownership, and asset management within the metaverse ecosystem.

These developments could facilitate seamless and secure virtual transactions and enhance user experiences. This has also made relatively good progress in China. As of the end of 2022, the stock of digital renminbi in circulation was 13.61 billion yuan, with a year-on-year growth rate of 15.3%.

Virtual KOLs (Key Opinion Leaders): Chinese metaverse platforms have embraced the concept of virtual influencers or virtual KOLs. These are computer-generated characters with distinct personalities and fan bases.

Virtual KOLs leverage AI and animation technologies to engage with users, providing unique marketing opportunities and content creation.

Example: The virtual idol girl group A-SOUL officially joined Keep and became a member energetic star promoter, opening an exclusive sports planet.

After becoming a Keep member, users can obtain A-SOUL’s voice packs and skins.

After completing relevant online challenges, they can also enjoy discounts on the exclusive sweet medals and the exclusive limited edition sweet backpack. Through multidimensional cooperation with virtual idols, Keep uses their influence to reach more Generation Z users, build new sports scenes for them, and inject this sports trend into the daily lives of more young users. Now it has 339,000 followers on Bilibili.

references:

https://36kr.com/p/2172130260707591

https://tech.gmw.cn/2023-08/03/content_36742244.htm

https://36kr.com/p/1962451664929025

https://news.cnstock.com/news,bwkx-202301-5005844.htm

![]() TVA: Could you give us some use cases where XR technologies are deployed in the creative industries?

TVA: Could you give us some use cases where XR technologies are deployed in the creative industries?

![]() ASHLEY DUDARENOK: XR (Extended Reality) technologies are increasingly being deployed in the creative industries to enhance and transform various aspects of artistic expression, marketing, entertainment, and more. Here are some use cases where XR technologies are commonly

ASHLEY DUDARENOK: XR (Extended Reality) technologies are increasingly being deployed in the creative industries to enhance and transform various aspects of artistic expression, marketing, entertainment, and more. Here are some use cases where XR technologies are commonly

deployed in the creative industries:

VR Exhibitions: VR allows artists and curators to create immersive virtual exhibitions, where users can explore digital galleries, interact with artwork, and experience installations from anywhere in the world.

e.g Tencent QQ X Gucci

Source :https://cj.sina.com.cn/sx/2023-07-07/doc-imyzwinr4918452.shtml

Tencent QQ partnered with Gucci in July 2023 to create a virtual exhibition hall for the ”Global Gucci” Collection Exhibition. Visitors can explore Gucci collection exhibits, participate in community chats, and win lottery prizes.

Augmented Reality (AR) Marketing and Advertising: AR is used to create interactive and engaging advertising campaigns. Brands can leverage AR to overlay digital content onto the real world, enabling users to visualize products in their environment or participate in branded AR experiences.

Augmented Reality (AR) Marketing and Advertising: AR is used to create interactive and engaging advertising campaigns. Brands can leverage AR to overlay digital content onto the real world, enabling users to visualize products in their environment or participate in branded AR experiences.

e.g. Tmall Luxurymeta Week AR digital fashion show in Sep, 2022, allowed users to interact with AR animation and take pictures.

Mirror of Tomorrow got 290 million views on Weibo.

https://zhuanlan.zhihu.com/p/624411745

XR Gaming and Entertainment: XR technologies, particularly VR, are transforming the gaming industry by providing immersive gameplay experiences.

Users can engage in virtual worlds, interact with characters, and explore environments in a more realistic and interactive manner.

e.g. Jay Chow Fantasy world (VR)

A metaverse has been created based on four songs from Jay Chow’s famous album (Fantasy), developed by JVR Music and Thin Box App to celebrate Fantasy’s 22nd anniversary.

Source: https://yule.sohu.com/a/722122220_100138535

● Play and connect: Users can enjoy playing games while collecting musical notes in the virtual space.

● Shop: buy digital assets as well as physical items offline.

● Over 3 million RMB virtual keys were sold in the first three days following the launch in September 2023, allow to listen to music.

● #Jay Chow Fantasy World got 170 million+ views on Weibo.

![]() TVA: What are the main challenges faced by Chinese creative industries for entering the” metaverse”, or using XR technologies?

TVA: What are the main challenges faced by Chinese creative industries for entering the” metaverse”, or using XR technologies?

![]() ASHLEY DUDARENOK: Weakening popularity of the Metaverse: People prefer outdoor activities after COVID-19 rather than playing XR devices at home.

ASHLEY DUDARENOK: Weakening popularity of the Metaverse: People prefer outdoor activities after COVID-19 rather than playing XR devices at home.

China’ consumer XR device sales in the third quarter of 2023 were sluggish, with 126,000 units sold, a 36.7% drop year-on-year.by early 2023, ByteDance and Tencent were streamlining their VR and XR teams.

Source: http://finance.itbear.com.cn/html/2023-11/6983.html

XR content quality and cost: A high development cost is associated with creating virtual reality content, which requires 3D modelling, texture materials, rendering, animation, and other technologies. According to Alibaba Cloud developer community users, a moderate VR game costs between USD$20 and USD$30 million.

Also, it is estimated that the development cost of a new series of VR games is USD $75 million- USD$100 million, according to Goldman Sachs.

https://www.vzkoo.com/read/20230818e4ffe4d079c14b661c2c40b8.html

Technology Infrastructure: In order to load the sophisticated elements of an XR scenario or application, a robust technology infrastructure is needed, including high-speed Internet, low-latency networks, and powerful computing power.

Ensuring widespread availability and accessibility of these technologies across China can be a challenge, particularly in rural areas.

![]() TVA: Are there any notable trends in consumer preferences within the XR space? What types of XR content are gaining traction in China?

TVA: Are there any notable trends in consumer preferences within the XR space? What types of XR content are gaining traction in China?

![]() ASHLEY DUDARENOK: Hardward: VR Brands preference

ASHLEY DUDARENOK: Hardward: VR Brands preference

The top five China VR equipment manufacturers in 2023Q3 are PICO,DPVR,IQUT (iQiyi VR), Goovis, and HTC Vive.

Source: https://www.elecfans.com/d/2314101.html

Content: VR concert

Source: http://www.soyouit.com/Netnews/2023-0908-8128.html

e.g. The VR concert, themed ”Summer Roaming’‘; connects four scenes or segments: summer roaming, song and dance performances, interactive games, and campfire talks.

By wearing the PICO VR all-in-one headset, the audience can instantly transcend time and space and embark on a journey of sunny beach roaming with A-SOUL, the virtual idol girl group, from a first-person perspective.# ASOUL Summer Roaming VR concert # got 150 million view on Weibo.

VR social community

Source: https://fashion.huanqiu.com/article/4AgIfVmkFSG

https://t.cj.sina.com.cn/articles/view/2064414402/7b0c76c200101a3v6

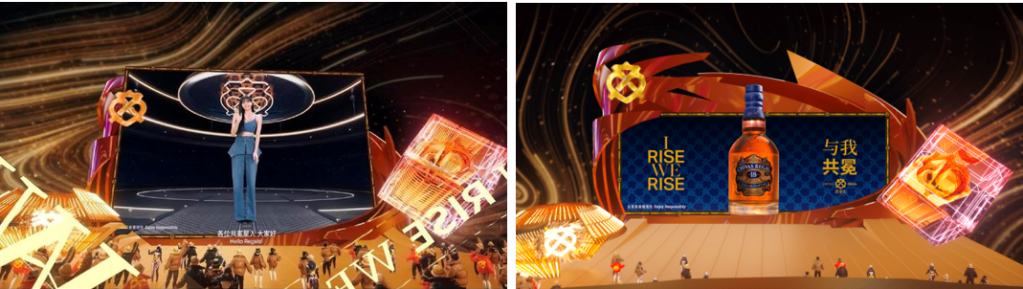

In Dec, 2022, Chivas partnered with Lisa, from Blackpink, to launch a virtual interactive space. Related Douyin topics got 67.23 million views. Through interactive games, players can unlock the ”Up Lobby”; (Rise Up Lobby); LISA’s image is presented on a virtual 3D screen on the ”Regal Stage” and participants can interact with LISA.

VR navigation

Source: https://www.hangzhou2022.cn/xwzx/jdxw/ttxw/202309/t20230903_70977.shtml

e.g. Using AR hybrid virtual technology, the 19th Hangzhou Asian Games venue in 2023 offered users real-life AR navigation.

![]() TVA : Can you share any exciting XR projects or collaborations that have taken place between Chinese companies and other countries; partners?

TVA : Can you share any exciting XR projects or collaborations that have taken place between Chinese companies and other countries; partners?

![]() ASHLEY DUDARENOK: Chinese search giant Baidu partnered with Qualcomm’s local unit to cooperate on extended reality (XR) technology and jointly create a new platform for the metaverse along with compatible services in September 2023. In 2021, Baidu launched its XiRang platform to support the development of the metaverse.

ASHLEY DUDARENOK: Chinese search giant Baidu partnered with Qualcomm’s local unit to cooperate on extended reality (XR) technology and jointly create a new platform for the metaverse along with compatible services in September 2023. In 2021, Baidu launched its XiRang platform to support the development of the metaverse.

Through the partnership with Qualcomm, Baidu is aiming to enhance the metaverse user experience by integrating Qualcomm’s Snapdragon Spaces™ XR developer platform and its cutting-edge XR technologies into the XiRang platform. This news comes just over a year after Qualcomm announced a similar partnership with TikTok owner Bytedance to develop XR technology so it would not be surprising to see similar partnerships with the likes of Tencent, Alibaba, Huawei, or Xiaomi in the near future.

![]() TVA : Is there a significant difference in the way XR technologies are utilized by Chinese consumers compared to consumers from other countries?

TVA : Is there a significant difference in the way XR technologies are utilized by Chinese consumers compared to consumers from other countries?

![]() ASHLEY DUDARENOK: According to data, consumers seem to be losing interest in the XR market.

ASHLEY DUDARENOK: According to data, consumers seem to be losing interest in the XR market.

According to data from RUNTO, in the first half of 2023, omni-channel sales of consumer XR devices (including AR and VR) in China were 382,000, a year- on-year decrease of 38.6%.

Among them, the sales volume of the online public retail market (excluding content e-commerce companies such as Douyin and Kuaishou) was 138,000, accounting for 36% of all channels, a year-on-year decrease of 40.2%; the sales volume was 430 million yuan, a year-on-year decrease of 36.5%.

The poor performance of the overall XR market is mainly dragged down by VR products.

According to online monitoring data from RUNTO, in the first half of the year, online sales of VR equipment were 97,000, a year-on-year decrease of 56%

![]() TVA: What are your predictions for the development of the Metaverse and XR technologies in China?

TVA: What are your predictions for the development of the Metaverse and XR technologies in China?

![]() ASHLEY DUDARENOK: In terms of the development trends in the XR industry, there are several dimensions to consider:

ASHLEY DUDARENOK: In terms of the development trends in the XR industry, there are several dimensions to consider:

Overall Industry Direction

Both VR (Virtual Reality) and AR (Augmented Reality) are technological approaches aiming towards the same goal of achieving Mixed Reality (MR), which combines virtual and real-world elements seamlessly.

There are two main routes to achieve this: one is through VR, which simulates real environments, and the other is Optical See Through (OST), which overlays virtual images onto the real world to create MR effects.

VR Hardware Maturity

Currently, VR hardware is relatively mature, but there are still two major challenges to overcome.

First, reducing the cost of VR devices is crucial to increase accessibility.

Second, the weight of VR headsets needs to be addressed because the current models can be too heavy for consumers to wear comfortably for extended periods.

In terms of the overall market landscape, the VR industry is mainly dominated by companies like Pico and Meta, with a few other notable players in the domestic market.

As VR hardware has become more mature, Apple has also entered the software realm of VR, signalling the involvement of more smartphone manufacturers in the VR space in the future.

Stages of AR Competition

The competition in the AR space might unfold in stages due to certain hardware- related challenges that still need to be addressed. As a result, major players have not fully entered the market.

However, since the hardware has recently crossed certain thresholds, there will undoubtedly be mature AR hardware products available in the next 2-3 years.

This period presents a window of opportunity for start-ups to establish their foothold in the industry.

They must utilize these two to three years to solidify their position, build industry barriers, establish their brand, accumulate users, and construct an ecosystem.

By doing so, they can leverage these resources and accumulations when the industry experiences significant growth and compete with the upcoming major players.

Overall, the XR industry is evolving towards achieving MR effects, with VR focusing on immersive simulations and AR aiming to overlay virtual elements onto the real world. While VR hardware is relatively mature, efforts are needed to reduce costs and make devices lighter.

In the AR space, there is a window of opportunity for startups to establish themselves before major players fully enter the market.

Metaverse No More? ByteDance And Tencent Scale Back VR Ambitions from Forbes

Two years after ByteDance acquired Chinese VR (virtual reality) headset manufacturer Pico for a whopping $1.3 billion, the tech giant is now reportedly downsizing and restructuring its VR division.

The move comes as enthusiasm for the metaverse has waned, and emerging technologies like ChatGPT have surged to the forefront, offering transformative potential for the tech industry.

ByteDance’s overhaul follows in the wake of Tencent’s strategic pivot in its XR (extended reality) development earlier this year, moving away from in-house hardware production.

Tencent is reportedly partnering with Meta Platforms to serve as the exclusive distributor of new, more affordable VR headsets in China with sales expected to begin in late 2024.

So, two of the highest-profile players in China’s VR market are scaling back.

Meanwhile, Meta’s Quest 3 VR headset also failed to meet expectations in the U.S.

The latest survey by analyst Ming-Chi Kuo indicates that Meta has reduced its Q4 shipment volume for Quest 3 by approximately 5%–10% this year, after market demand fell short of expectations.

Setting aside the internal situations of these companies, at the industry level, there are certain challenges that VR primarily faces in the consumer market.

Users often experience ‘‘dizziness” when wearing VR devices for extended periods, which affects the overall user experience.

Additionally, issues such as the approval process for gaming licenses in China also impact market patience and growth. As for AR, there is still room for improvement in optical and performance aspects, and a comprehensive trade-off needs to be made between system capabilities, computing power, and product weight.

And before we dive shortly into TechvangArt Crazy-Shot Questions :), a book recommendation for those who want to know more about Metaverse in China and how business are using it, which companies are creating it. The book can be found HERE

![]() Do you plan to have a digital twin earning from marketing in the Metaverse?

Do you plan to have a digital twin earning from marketing in the Metaverse?

![]() ASHLEY DUDARENOK: Absolutely, when the technology and the environments are developed enough.

ASHLEY DUDARENOK: Absolutely, when the technology and the environments are developed enough.

![]() TVA The craziest Metaverse thing you liked?

TVA The craziest Metaverse thing you liked?![]() ASHLEY DUDARENOK:Real metaverse doesn’t exist yet. When it’s there, I’ll tell you. 🙂

ASHLEY DUDARENOK:Real metaverse doesn’t exist yet. When it’s there, I’ll tell you. 🙂

![]() TVA: Are there any ridiculous or amusing misconceptions about the Metaverse or XR technologies among the general public in China?

TVA: Are there any ridiculous or amusing misconceptions about the Metaverse or XR technologies among the general public in China?

![]() ASHLEY DUDARENOK: The demand for XR devices in China differs greatly from the overseas market.

ASHLEY DUDARENOK: The demand for XR devices in China differs greatly from the overseas market.

Overseas users have already been familiarized with the concept of home consoles through gaming consoles and televisions.

The Oculus Quest, in particular, has successfully competed for usage time against televisions and gaming consoles, converting television users into ”Quest users” and establishing a vibrant community.

Indeed, there is a lack of a solid foundation in China to drive widespread enthusiasm for XR devices among the general public.

Opportunities such as VR live streaming and VR concerts occasionally emerge, which seem to have the potential to break through barriers. However, they often encounter issues such as poor display quality and a scarcity of content within the ecosystem.

These challenges hinder the broader adoption of XR devices in China.

![]() TVA: If you could have an XR experience that allowed you to fly like a superhero, where would you go and who would you save?

TVA: If you could have an XR experience that allowed you to fly like a superhero, where would you go and who would you save?

![]() ASHLEY DUDARENOK: I’ll be flying over the ocean and rainforests, protecting wildlife and mother nature from human greed, helping someone like Sea Shepherds.

ASHLEY DUDARENOK: I’ll be flying over the ocean and rainforests, protecting wildlife and mother nature from human greed, helping someone like Sea Shepherds.

(https://seashepherd.org/)

![]() If the world collapses, and you can save only one book, which book will you save?

If the world collapses, and you can save only one book, which book will you save?![]() ASHLEY DUDARENOK: Guns, Germs, and Steel, by Jared Diamond.

ASHLEY DUDARENOK: Guns, Germs, and Steel, by Jared Diamond.

![]() Favourite childhood story?

Favourite childhood story?![]() ASHLEY DUDARENOK: Alice in Wonderland, so full of color, curiocity, life, imagination, quirkiness and more.

ASHLEY DUDARENOK: Alice in Wonderland, so full of color, curiocity, life, imagination, quirkiness and more.

![]() If Santa Claus was a brand, how would you position him against other holiday characters such as the Easter Bunny or Tooth Fairy?

If Santa Claus was a brand, how would you position him against other holiday characters such as the Easter Bunny or Tooth Fairy?

![]() ASHLEY DUDARENOK: Santa is a brand, perhaps the world’s strongest. Here’s a good story about it . His brand stands for happiness (thanks to Coke), cheer, kindness, magic and togetherness.

ASHLEY DUDARENOK: Santa is a brand, perhaps the world’s strongest. Here’s a good story about it . His brand stands for happiness (thanks to Coke), cheer, kindness, magic and togetherness.

The Article on TechvangArt includes PHOTO and VIDEO content and written materials that have been published with the permission of Ashley Dudarenok